Do You Pay Personal Property Tax On Leased Vehicles In South Carolina . Web business personal property is assessed at 10.5%. Web if you pay personal property tax on a leased vehicle, you can deduct that expense on your federal tax return. Web the $300 tax cap is on sales tax, not the personal property tax. All businesses are required to file business personal. Web if your home of record is not south carolina, you do not have to pay personal property taxes on personal property you own, while. The following is a partial list. That amount is based off of your local and. Web in some places, you'll have to pay sales or excise tax on the amount you put down plus your monthly payments. Web this page describes the taxability of leases and rentals in south carolina, including motor vehicles and tangible media property.

from nextdoor.com

Web if you pay personal property tax on a leased vehicle, you can deduct that expense on your federal tax return. The following is a partial list. Web this page describes the taxability of leases and rentals in south carolina, including motor vehicles and tangible media property. Web in some places, you'll have to pay sales or excise tax on the amount you put down plus your monthly payments. Web if your home of record is not south carolina, you do not have to pay personal property taxes on personal property you own, while. Web business personal property is assessed at 10.5%. That amount is based off of your local and. Web the $300 tax cap is on sales tax, not the personal property tax. All businesses are required to file business personal.

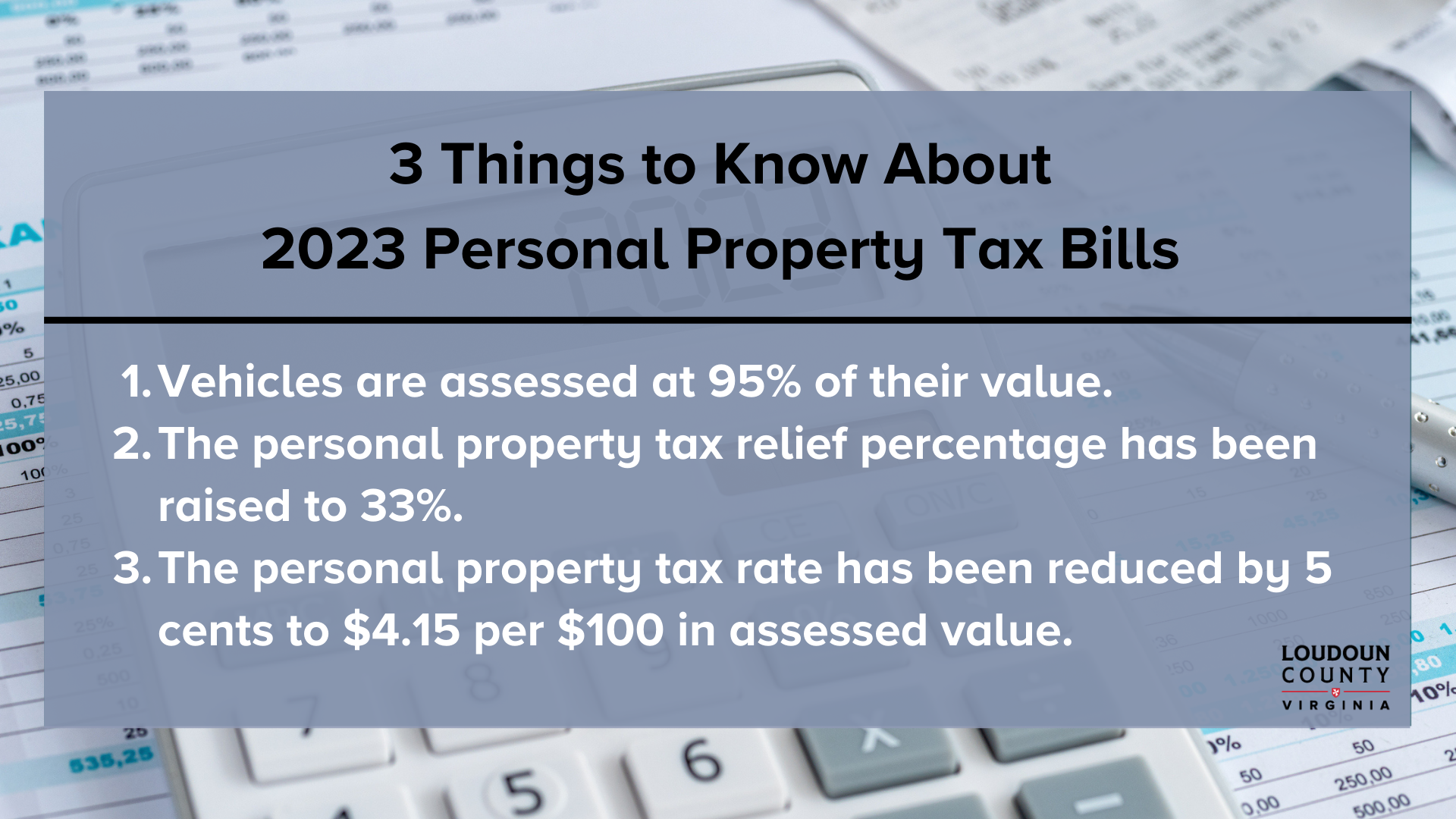

Three Things to Know About 2023 Personal Property Tax Bills (Loudoun

Do You Pay Personal Property Tax On Leased Vehicles In South Carolina Web if you pay personal property tax on a leased vehicle, you can deduct that expense on your federal tax return. All businesses are required to file business personal. Web in some places, you'll have to pay sales or excise tax on the amount you put down plus your monthly payments. Web the $300 tax cap is on sales tax, not the personal property tax. The following is a partial list. Web if you pay personal property tax on a leased vehicle, you can deduct that expense on your federal tax return. Web if your home of record is not south carolina, you do not have to pay personal property taxes on personal property you own, while. Web this page describes the taxability of leases and rentals in south carolina, including motor vehicles and tangible media property. That amount is based off of your local and. Web business personal property is assessed at 10.5%.

From www.quickenloans.com

Real Estate Taxes Vs. Property Taxes Quicken Loans Do You Pay Personal Property Tax On Leased Vehicles In South Carolina All businesses are required to file business personal. Web if your home of record is not south carolina, you do not have to pay personal property taxes on personal property you own, while. The following is a partial list. Web if you pay personal property tax on a leased vehicle, you can deduct that expense on your federal tax return.. Do You Pay Personal Property Tax On Leased Vehicles In South Carolina.

From cermgltl.blob.core.windows.net

Pay Personal Property Tax Online Raleigh County Wv at Joseph Gonzales blog Do You Pay Personal Property Tax On Leased Vehicles In South Carolina Web in some places, you'll have to pay sales or excise tax on the amount you put down plus your monthly payments. Web this page describes the taxability of leases and rentals in south carolina, including motor vehicles and tangible media property. All businesses are required to file business personal. That amount is based off of your local and. Web. Do You Pay Personal Property Tax On Leased Vehicles In South Carolina.

From psychoautos.com

Do You Pay Property Tax On A Leased Car? Explained Simply Do You Pay Personal Property Tax On Leased Vehicles In South Carolina The following is a partial list. Web in some places, you'll have to pay sales or excise tax on the amount you put down plus your monthly payments. All businesses are required to file business personal. That amount is based off of your local and. Web this page describes the taxability of leases and rentals in south carolina, including motor. Do You Pay Personal Property Tax On Leased Vehicles In South Carolina.

From www.icsl.edu.gr

Do You Pay Property Tax On A Leased Car Do You Pay Personal Property Tax On Leased Vehicles In South Carolina The following is a partial list. That amount is based off of your local and. Web the $300 tax cap is on sales tax, not the personal property tax. Web this page describes the taxability of leases and rentals in south carolina, including motor vehicles and tangible media property. Web if your home of record is not south carolina, you. Do You Pay Personal Property Tax On Leased Vehicles In South Carolina.

From pcz-jvtm6.blogspot.com

do you pay property taxes on a leased car Knocked Up Vlog Photogallery Do You Pay Personal Property Tax On Leased Vehicles In South Carolina Web if you pay personal property tax on a leased vehicle, you can deduct that expense on your federal tax return. Web in some places, you'll have to pay sales or excise tax on the amount you put down plus your monthly payments. The following is a partial list. All businesses are required to file business personal. Web business personal. Do You Pay Personal Property Tax On Leased Vehicles In South Carolina.

From chryslercapital.com

How to optimize your tax refund when you buy or lease a car Chrysler Do You Pay Personal Property Tax On Leased Vehicles In South Carolina Web if your home of record is not south carolina, you do not have to pay personal property taxes on personal property you own, while. Web this page describes the taxability of leases and rentals in south carolina, including motor vehicles and tangible media property. The following is a partial list. Web the $300 tax cap is on sales tax,. Do You Pay Personal Property Tax On Leased Vehicles In South Carolina.

From www.countyforms.com

Charleston County Property Tax Forms Do You Pay Personal Property Tax On Leased Vehicles In South Carolina The following is a partial list. Web in some places, you'll have to pay sales or excise tax on the amount you put down plus your monthly payments. All businesses are required to file business personal. Web if your home of record is not south carolina, you do not have to pay personal property taxes on personal property you own,. Do You Pay Personal Property Tax On Leased Vehicles In South Carolina.

From psychoautos.com

Do You Pay Property Tax On A Leased Car? Explained Simply Do You Pay Personal Property Tax On Leased Vehicles In South Carolina The following is a partial list. Web in some places, you'll have to pay sales or excise tax on the amount you put down plus your monthly payments. Web the $300 tax cap is on sales tax, not the personal property tax. Web if your home of record is not south carolina, you do not have to pay personal property. Do You Pay Personal Property Tax On Leased Vehicles In South Carolina.

From www.youtube.com

Understanding Business Personal Property Tax Requirements YouTube Do You Pay Personal Property Tax On Leased Vehicles In South Carolina Web in some places, you'll have to pay sales or excise tax on the amount you put down plus your monthly payments. Web business personal property is assessed at 10.5%. The following is a partial list. Web if you pay personal property tax on a leased vehicle, you can deduct that expense on your federal tax return. All businesses are. Do You Pay Personal Property Tax On Leased Vehicles In South Carolina.

From fnrpusa.com

How to Estimate Commercial Real Estate Property Taxes FNRP Do You Pay Personal Property Tax On Leased Vehicles In South Carolina That amount is based off of your local and. The following is a partial list. Web if your home of record is not south carolina, you do not have to pay personal property taxes on personal property you own, while. Web the $300 tax cap is on sales tax, not the personal property tax. Web if you pay personal property. Do You Pay Personal Property Tax On Leased Vehicles In South Carolina.

From safebooksglobal.com

How to pay personal property tax online? Safebooks Global Do You Pay Personal Property Tax On Leased Vehicles In South Carolina Web this page describes the taxability of leases and rentals in south carolina, including motor vehicles and tangible media property. Web the $300 tax cap is on sales tax, not the personal property tax. Web in some places, you'll have to pay sales or excise tax on the amount you put down plus your monthly payments. All businesses are required. Do You Pay Personal Property Tax On Leased Vehicles In South Carolina.

From www.pinterest.com

Who Pays the Personal Property Tax on a Leased Car? Property tax Do You Pay Personal Property Tax On Leased Vehicles In South Carolina Web this page describes the taxability of leases and rentals in south carolina, including motor vehicles and tangible media property. Web if your home of record is not south carolina, you do not have to pay personal property taxes on personal property you own, while. Web the $300 tax cap is on sales tax, not the personal property tax. Web. Do You Pay Personal Property Tax On Leased Vehicles In South Carolina.

From www.kaigi.biz

Personal Property Tax On Leased Vehicles Do You Pay Personal Property Tax On Leased Vehicles In South Carolina Web if you pay personal property tax on a leased vehicle, you can deduct that expense on your federal tax return. Web the $300 tax cap is on sales tax, not the personal property tax. Web this page describes the taxability of leases and rentals in south carolina, including motor vehicles and tangible media property. The following is a partial. Do You Pay Personal Property Tax On Leased Vehicles In South Carolina.

From nextdoor.com

Vehicle Personal Property Tax Bills Are Coming (Arlington County Do You Pay Personal Property Tax On Leased Vehicles In South Carolina Web if you pay personal property tax on a leased vehicle, you can deduct that expense on your federal tax return. Web business personal property is assessed at 10.5%. The following is a partial list. Web the $300 tax cap is on sales tax, not the personal property tax. Web in some places, you'll have to pay sales or excise. Do You Pay Personal Property Tax On Leased Vehicles In South Carolina.

From my-unit-property-9.netlify.app

Real Estate Property Tax By State Do You Pay Personal Property Tax On Leased Vehicles In South Carolina Web business personal property is assessed at 10.5%. Web in some places, you'll have to pay sales or excise tax on the amount you put down plus your monthly payments. The following is a partial list. All businesses are required to file business personal. Web if your home of record is not south carolina, you do not have to pay. Do You Pay Personal Property Tax On Leased Vehicles In South Carolina.

From www.gfrservices.com

Understanding Property Taxes on Your Leased Equipment Global Do You Pay Personal Property Tax On Leased Vehicles In South Carolina Web the $300 tax cap is on sales tax, not the personal property tax. Web business personal property is assessed at 10.5%. Web if you pay personal property tax on a leased vehicle, you can deduct that expense on your federal tax return. Web this page describes the taxability of leases and rentals in south carolina, including motor vehicles and. Do You Pay Personal Property Tax On Leased Vehicles In South Carolina.

From www.wvva.com

WV taxpayers eligible for Motor Vehicle Property Tax Adjustment Credit Do You Pay Personal Property Tax On Leased Vehicles In South Carolina Web business personal property is assessed at 10.5%. The following is a partial list. All businesses are required to file business personal. That amount is based off of your local and. Web in some places, you'll have to pay sales or excise tax on the amount you put down plus your monthly payments. Web if your home of record is. Do You Pay Personal Property Tax On Leased Vehicles In South Carolina.

From printablethereynara.z14.web.core.windows.net

Va Tax Pay Online Do You Pay Personal Property Tax On Leased Vehicles In South Carolina All businesses are required to file business personal. That amount is based off of your local and. Web this page describes the taxability of leases and rentals in south carolina, including motor vehicles and tangible media property. Web if your home of record is not south carolina, you do not have to pay personal property taxes on personal property you. Do You Pay Personal Property Tax On Leased Vehicles In South Carolina.